Coherent risk measure

In the field of financial economics there are a number of ways that risk can be defined; to clarify the concept theoreticians have described a number of properties that a risk measure might or might not have. A coherent risk measure is a function ρ that satisfies properties of monotonicity, sub-additivity, homogeneity, and translational invariance.

Contents |

Properties

Consider a random outcome  viewed as an element of a linear space

viewed as an element of a linear space  of measurable functions, defined on an appropriate probability space. A functional

of measurable functions, defined on an appropriate probability space. A functional  →

→  is said to be coherent risk measure for

is said to be coherent risk measure for  if it satisfies the following properties:[1]

if it satisfies the following properties:[1]

- Normalized

That is, the risk of holding no assets is zero.

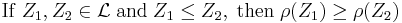

- Monotonicity

That is, if portfolio  always has better values than portfolio

always has better values than portfolio  under all scenarios then the risk of

under all scenarios then the risk of  should be less than the risk of

should be less than the risk of  .[2]

.[2]

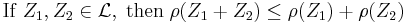

- Sub-additivity

Indeed, the risk of two portfolios together cannot get any worse than adding the two risks separately: this is the diversification principle.

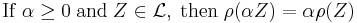

- Positive homogeneity

Loosely speaking, if you double your portfolio then you double your risk.

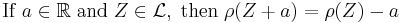

- Translation invariance

The value  is just adding cash to your portfolio

is just adding cash to your portfolio  , which acts like an insurance: the risk of

, which acts like an insurance: the risk of  is less than the risk of

is less than the risk of  , and the difference is exactly the added cash

, and the difference is exactly the added cash  . In particular, if

. In particular, if  then

then  .

.

Convex risk measures

The notion of coherence has been subsequently relaxed. Indeed, the notions of Sub-additivity and Positive Homogeneity can be replaced by the notion of convexity:[3]

- Convexity

![If \ Z_1,Z_2 \in \mathcal{L}\text{ and }\lambda \in [0,1] \text{ then }\rho(\lambda Z_1 %2B (1-\lambda) Z_2) \leq \lambda \rho(Z_1) %2B (1-\lambda) \rho(Z_2)](/2012-wikipedia_en_all_nopic_01_2012/I/fd68401ebcb20e098cbbdd1347b441c6.png)

Examples

Value at risk

It is well known that value at risk is not, in general, a coherent risk measure as it does not respect the sub-additivity property. An immediate consequence is that value at risk might discourage diversification.

Value at risk is, however, coherent, under the assumption of elliptically distributed losses (e.g. normally distributed) when the portfolio value is a linear function of the asset prices. However, in this case the value at risk becomes equivalent to a mean-variance approach where the risk of a portfolio is measured by the variance of the portfolio's return.

Illustration

As a simple example to demonstrate the non-coherence of value-at-risk consider looking at the VaR of a portfolio at 95% confidence over the next year of two default-able zero coupon bonds that mature in 1 years time denominated in our numeraire currency.

Assume the following:

- The current yield on the two bonds is 0%

- The two bonds are from different issuers

- Each bonds has a 4% probability of defaulting over the next year

- The event of default in either bond is independent of the other

- Upon default the bonds have a recovery rate of 30%

Under these conditions the 95% VaR for holding either of the bonds is 0% since the probability of default is less than 5%. However if we held a portfolio that consisted of 50% of each bond by value then the 95% VaR is 35% since the probability of at least one of the bonds defaulting is 7.84% which exceeds 5%. This violates the sub-additivity property showing that VaR is not a coherent risk measure.

Average value at risk

The average value at risk (sometimes called expected shortfall or conditional value-at-risk) is a coherent risk measure, even though it is derived from Value at Risk which is not.

Tail value at risk

The tail value at risk (or tail conditional expectation) is a coherent risk measure only when the underlying distribution is continuous.

Entropic risk measure

The entropic risk measure is a convex risk measure which is not coherent. It is related to the exponential utility.

Superhedging price

The superhedging price is a coherent risk measure.

Set-valued

In a situation with  -valued portfolios such that risk can be measured in

-valued portfolios such that risk can be measured in  of the assets, then a set of portfolios is the proper way to depict risk. Set-valued risk measures are useful for markets with transaction costs.[4]

of the assets, then a set of portfolios is the proper way to depict risk. Set-valued risk measures are useful for markets with transaction costs.[4]

Properties

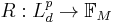

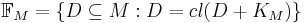

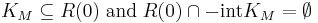

A set-valued coherent risk measure is a function  , where

, where  and

and  where

where  is a constant solvency cone and

is a constant solvency cone and  is the set of portfolios of the

is the set of portfolios of the  reference assets.

reference assets.  must have the following properties:[5]

must have the following properties:[5]

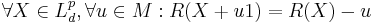

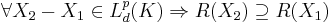

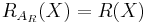

- Normalized

- Translative in M

- Monotone

- Sublinear

Set-valued convex risk measure

If instead of the sublinear property,R is convex, then R is a set-valued convex risk measure.

Relation to Acceptance Sets

An acceptance set is convex (coherent) if and only if the corresponding risk measure is convex (coherent). As defined below it can be shown that  and

and  .

.

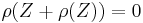

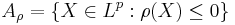

Risk Measure to Acceptance Set

- If

is a (scalar) risk measure then

is a (scalar) risk measure then  is an acceptance set.

is an acceptance set. - If

is a set-valued risk measure then

is a set-valued risk measure then  is an acceptance set.

is an acceptance set.

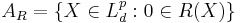

Acceptance Set to Risk Measure

- If

is an acceptance set (in 1-d) then

is an acceptance set (in 1-d) then  defines a (scalar) risk measure.

defines a (scalar) risk measure. - If

is an acceptance set then

is an acceptance set then  is a set-valued risk measure.

is a set-valued risk measure.

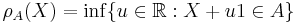

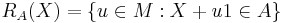

Dual representation

A convex risk measure  can be represented as

can be represented as

such that  is a penalty function.

is a penalty function.

A risk measure is coherent if and only if it can be represented as

such that  .[6]

.[6]

Relation to deviation risk measure

If ![D(X) < \mathbb{E}[X] - \operatorname{ess\inf} X](/2012-wikipedia_en_all_nopic_01_2012/I/b1f14e54996a5b315987c8e419ee8a3f.png) for every X (where

for every X (where  is the essential infimum) is a deviation risk measure, then there is a one-to-one relationship between D and an expectation-bounded coherent risk measure

is the essential infimum) is a deviation risk measure, then there is a one-to-one relationship between D and an expectation-bounded coherent risk measure  where for any

where for any

![D(X) = R(X - \mathbb{E}[X])](/2012-wikipedia_en_all_nopic_01_2012/I/716e9df41706e2e2a69df0ed075dfb68.png)

![R(X) = D(X) - \mathbb{E}[X]](/2012-wikipedia_en_all_nopic_01_2012/I/9b503c776ba9ca37cd0b28d406ad3485.png) .

.

is expectation bounded if

is expectation bounded if ![\rho(X) > \mathbb{E}[-X]](/2012-wikipedia_en_all_nopic_01_2012/I/a7795d7e4730e72fa0f4d899d07ed88f.png) for any nonconstant X and

for any nonconstant X and ![\rho(X) = \mathbb{E}[-X]](/2012-wikipedia_en_all_nopic_01_2012/I/333bbe7f31e3642b13af07ea5e73af5e.png) for any constant X.[7]

for any constant X.[7]

References

- ^ Artzner, Philippe; Delbaen, Freddy; Eber, Jean-Marc; Heath, David (1999). "Coherent Measures of Risk" (pdf). Mathematical Finance 9 (3): 203–228. http://www.math.ethz.ch/~delbaen/ftp/preprints/CoherentMF.pdf. Retrieved February 3, 2011.

- ^ Wilmott, P. (2006). Quantitative Finance. 1 (2 ed.). Wiley. p. 342.

- ^ Föllmer, H.; Schied, A. (2002). "Convex measures of risk and trading constraints". Finance and Stochastics 6 (4): 429–447.

- ^ Jouini, Elyes; Meddeb, Moncef; Touzi, Nizar (2004). "Vector–valued coherent risk measures". Finance and Stochastics 8 (4): 531–552.

- ^ Hamel, Andreas; Heyde, Frank (December 11, 2008) (pdf). Duality for Set-Valued Risk Measures. http://www.princeton.edu/~ahamel/SetRiskHamHey.pdf. Retrieved July 22, 2010.

- ^ Föllmer, Hans; Schied, Alexander (2004). Stochastic finance: an introduction in discrete time (2 ed.). Walter de Gruyter. ISBN 9783110183467.

- ^ Rockafellar, Tyrrell; Uryasev, Stanislav; Zabarankin, Michael (2002) (pdf). Deviation Measures in Risk Analysis and Optimization. http://www.ise.ufl.edu/uryasev/Deviation_measures_wp.pdf. Retrieved October 13, 2011.}}

External links

- A list of important papers on coherent and convex risk measures

- Glyn Holton: The Case for Incoherence Controversial article that argues coherence is not a desirable property. "There are two types of risk metrics – coherent and incoherent. In the vast majority of cases, you want one that is incoherent."

See also

- RiskMetrics

- Spectral risk measure - a subset of coherent risk measures

![\rho(X) = \sup_{Q \in \mathcal{M}_1} \{E^Q[-X] - \alpha(Q)\}](/2012-wikipedia_en_all_nopic_01_2012/I/5b72556502c1e59dd19a35b566ae6a41.png)

![\rho(X) = \sup_{Q \in \mathcal{Q}} E^Q[-X]](/2012-wikipedia_en_all_nopic_01_2012/I/71e25685c02125e3418333dd0eaf43d6.png)